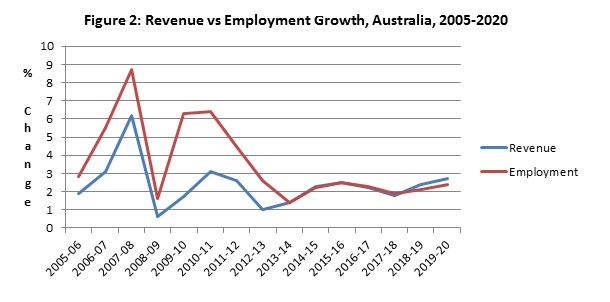

The Motor Vehicle New Parts wholesaling industry in Australia is driven by demand in two key markets, the provision of new parts for the: 1) Manufacture of new motor vehicles; and 2) service of aftermarket parts. The demand for new parts in the manufacture of new vehicles has been in decline for a number of years as Australians have shown a preference for smaller, more fuel-efficient, imported vehicles. This will continue up until 2017 when the three remaining manufacturers in Australia, Toyota, Ford, and Holden, will cease their manufacturing operations in Australia.

That decline in Industry growth would be much more pronounced if not for the strong performance in the provision of new parts for the aftermarket industry. In the aftermath of the Global Financial Crisis many Australians put off making significant purchases such as new cars and elected instead to look after the ones they had, which increased the demand for replacement parts.

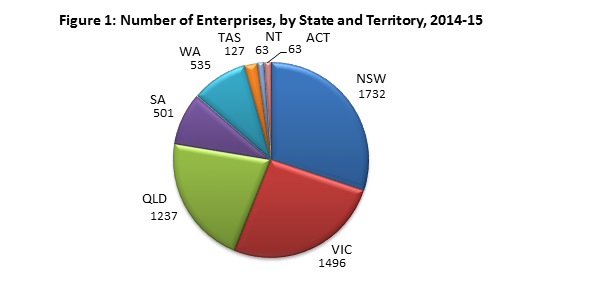

There will still be a need for the provision of new vehicle parts after car manufacturing in Australia ceases in 2017. Australians will always need replacement parts, but there will be an increasing reliance on parts from overseas. There will still be manufacturing in Australia to a number of niche clientele, but the demand will be greatly diminished. Smaller businesses will be forced to close or be taken over by larger companies as growth continues to decline over the next few years.

Download . pdf